Insurance policyholders have to make claims when they want to request that the insurance company pay them to cover all the expenses that they have incurred. This is usually done when someone has purchased an insurance policy and there is a promise or a contract between the company and the policy to fulfill each other’s needs.

Gone are the days when people had to write a claim letter in which they would request the company for the repayment of the money. Writing a letter was also a good strategy; however, those who could not communicate well with the company would often fail to get the claim. It also causes inconvenience to companies because they have to ask the policyholders for more details. Considering all these problems, the forms for making a claim were introduced.

What is a claim form for health insurance policies?

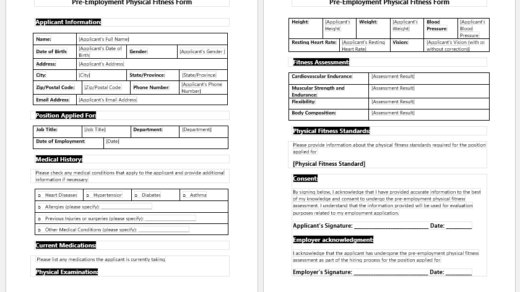

It is a document with a number of empty fields. These fields are required to be filled out by the claimant, and once they are, they are ready to submit. This form is generally used by healthcare practitioners on behalf of their patients, who are the policyholders of a health insurance company. By filling out this form, doctors let the insurance company know that they have treated the patient who wants to make a claim. In some cases, the patient also fills out this form to make a claim, but the insurance company believes more in the authenticity of the treatment if it comes directly from the hospital.

When should I fill out the claim form for health insurance policies?

There is no hard-and-fast rule as to when to use this form. Many people like the form to be used when they have already undergone treatment and have paid the money, and now they want to be compensated. Some people claim to advance. In most companies, it generally depends on the preference and policy of the company, as the policyholders must abide by the rules and policies of the company.

What does a claim form for a health insurance company do?

A claim form includes information needed by the insurance company to process the claim. When an insurance company takes on the responsibility of covering the medical expenses of the patient, who is also the policyholder at the same time, it has to get confirmation from various aspects that the claim that the policyholder is making is true and is not misleading.

The form provides information that can be confirmed and attested to through various sources before it is decided whether the claim should be approved or not. Hospitals can use this form just before or after the treatment, and they fill it out on behalf of the patient.

What should I do to get approval for the reimbursement request?

When you are filing the form, you don’t know if your claim request will be approved or not. However, you want to try your best to get it approved. For this purpose, you need to remember the following points:

- Provide the correct information

Whether it is being filled out by the doctor or the patient, the information should be accurate and correct. The insurance company always verifies the information, and if, upon verification, it turns out that it is not accurate, it can lead to the rejection of the claim.

- Fill out every field

You can’t fill in the details that you find feasible. Rather, you will have to fill out each and every part of the form. Some companies put the * sign in front of the fields that are mandatory to fill, and the rest are not mandatory, and users can skip them if they are not relevant or necessary.

- Read the instructions carefully

Before filling out the form, there are instructions at the top that should be read, as they are very helpful in filling it out. If you follow all the guidelines, you will be able to fill out the form more appropriately, and this way, it will be easier for the insurance company to process the compensation request.

- Mental Health Evaluation Forms

- Forms Used by Pediatricians

- Various Forms Related to Pregnancy Verification

- Common Forms Used by ENT Specialists

- Pain Diary Worksheet Template

- Forms Commonly Used by Old Age Homes

- Medical Treatment Consent Form

- Home Exercise Program Worksheet

- Forms Used for Mental Health Assessment

- Forms Used by Psychologists

- Medical Forms Commonly Used by/for Students

- Assessment Consent Form

- Forms Used by an Anesthesiologist

- Not Fit to Fly Certificate Template

- Home Visit Consent Form for Schools